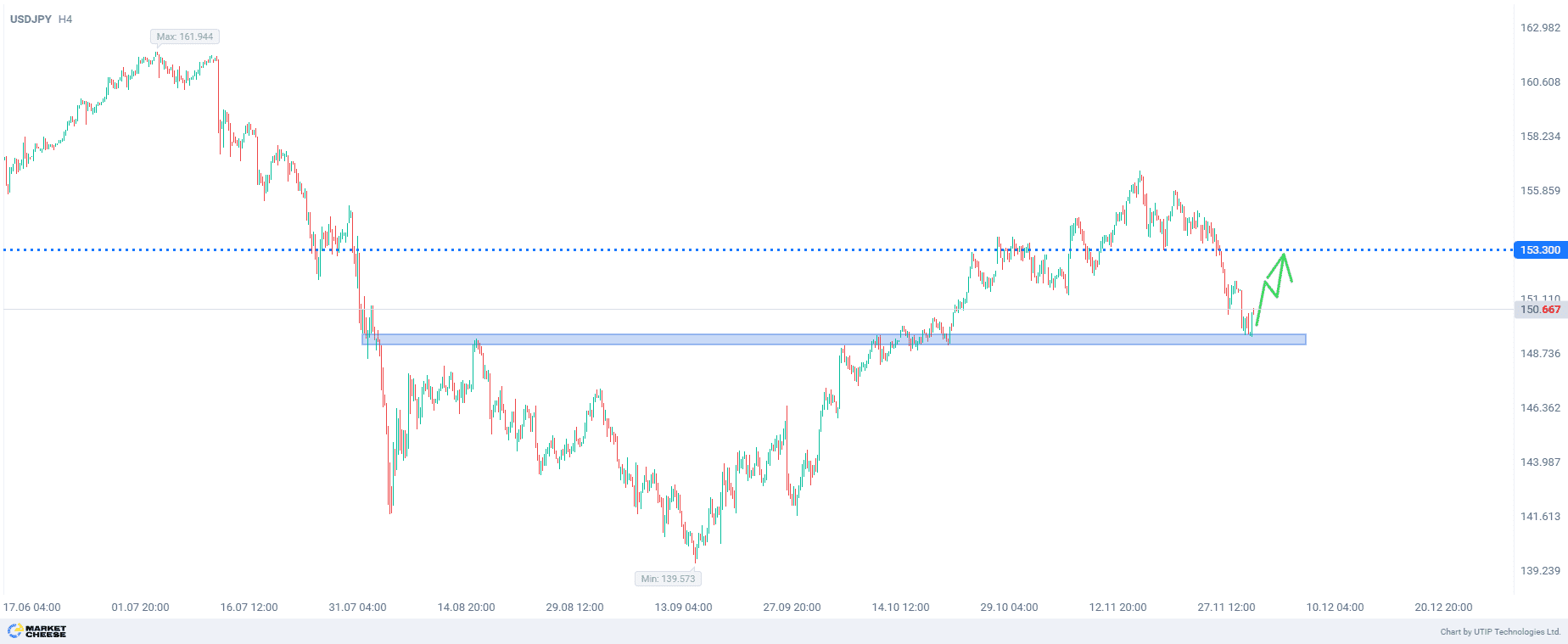

USDJPY corrects to 153.3

The USDJPY currency pair last week completed a bearish correction to the previously targeted level of 149.5. The price movement to this mark was determined by the presence of the local maximum, formed in mid-August. Having tested this level, the USDJPY currency pair quotes are ready to move upwards from the technical point of view. The likely target of this upward movement is the level of 153.3. This is the mark at which a bearish reversal of the pair took place earlier, with a subsequent breach of this level.

Fundamentally, this reversal was supported by the opposite actions of the US and Japanese regulators, with the former moving towards easing and the latter towards tightening.

By and large, such multidirectional actions will continue for 6 to 18 months. On the other hand, there will always be reasons for corrective upward moves on shorter time horizons. Friday will see the release of the November employment data, and if it looks overheated to investors, it will lead to another round of dollar strength. In addition, Trump’s new proposals for deals with the BRICS developing countries, aimed at preserving the US currency as the main means of payment, will add fuel to the fire. And that, in turn, will provide additional support for the dollar.

Another surprise for the Japanese regulator could be the upcoming release of the national consumer price index on 20 December. The fact is that despite all the optimistic statements by the Governor of the Bank of Japan, the actual CPI has been falling steadily since August, and each time it has been lower than forecast expectations. And this trend could seriously undermine the case for monetary tightening in Japan.

The overall recommendation is to buy USDJPY.

Profit could be taken at 153.30. A stop loss could be set at 147.00.

The volume of the opened position should be set so that the value of a possible loss, defined with a protective stop order, does not exceed 1% of your deposit.