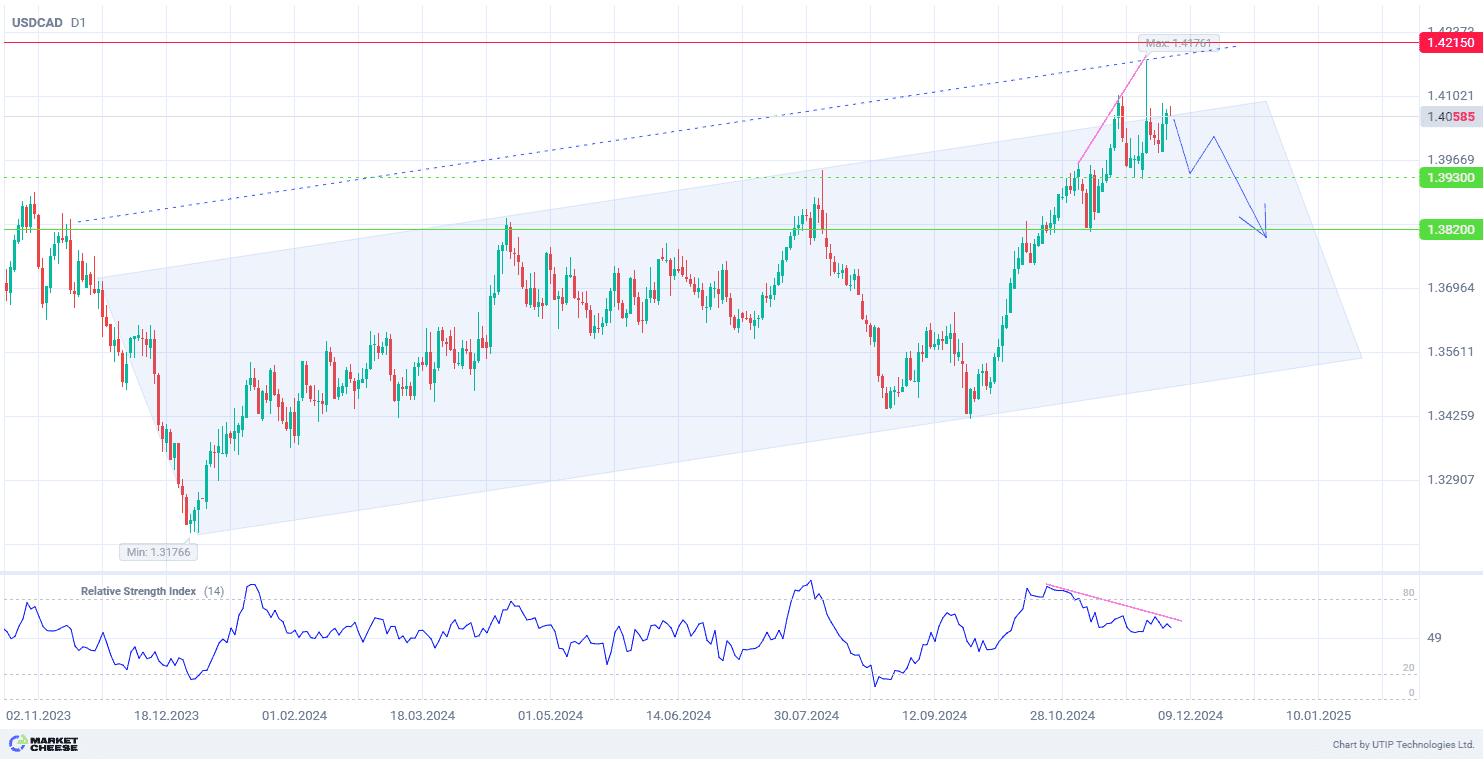

USDCAD decline possible amid market uncertainty

USDCAD stabilized around the 1.4060 level on Wednesday, and remained near the weekly high. However, an uncertain fundamental backdrop is holding back further gains.

As one of the world’s largest producers of commodities, including oil, Canada’s currency is highly dependent on market sentiment. Energy prices are consolidating after a sharp rise the day before on expectations that OPEC+ will extend supply cuts. Geopolitical tensions in the Middle East are providing additional support for oil prices. These factors, along with reduced odds of further rate cuts by the Bank of Canada in December, are supporting the Canadian dollar.

On the other hand, the US dollar remains under pressure as market participants are reluctant to make significant bets ahead of Federal Reserve Chairman Jerome Powell’s speech.

Traders are focusing on Friday’s release of the US Nonfarm Payrolls report. This statistic may provide more insight into the Fed’s monetary policy outlook.

Also on Friday, Canada’s employment report for November is expected to be released, which may alter expectations for further interest rate cuts by the Bank of Canada. Market participants are expecting a gain of 25,000 jobs. This is a positive factor for the local currency.

From a technical point of view, the price of USDCAD continues to show an upward trend on the daily timeframe (D1). The price marked the local trend resistance after exiting the channel. After rebounding from the resistance line, the pair returned to the previously formed trend. However, the uncertainty in the market and the overbought condition of the pair may lead to a correction. In addition, the divergence of the Relative Strength Index (RSI) (standard values) indicates the possibility of a change in price direction towards the trend support of the ascending channel.

Signal:

Short-term prospects for USDCAD suggest selling.

The target is at the level of 1.3820.

Part of the profit should be taken near the level of 1.3930.

A stop-loss could be placed at the level of 1.4215.

The bearish trend is short-term, so trade volume should not exceed 2% of your balance.