Silver loses ground amid New Year’s Eve uncertainty

Silver declined last week, reflecting weakness amid holiday trading and low liquidity. Markets closely watch economic signals from the US as they await policy moves by Donald Trump and the Federal Reserve’s (Fed) decision on interest rates in 2025.

While gold may attract buying interest as a hedging instrument, silver is likely to follow but with less certainty.

Moderate US Personal Consumer Expenditure (PCE) index data lowered expectations of aggressive monetary policy easing next year. This limits the upside potential for silver, which, unlike gold, combines the functions of a protective asset and an industrial metal. Geopolitical tensions, which traditionally support demand for safe haven assets, also failed to provide silver with a stable upward momentum.

Production and demand figures remain important. In 2024, silver production is expected to be 1.03 billion ounces. At the same time, demand is projected at 1.21 billion ounces. The market deficit will remain for the fourth consecutive year at 182 million ounces. Despite sustained industrial demand, especially in the renewable energy and electric vehicle segments, the market remains vulnerable to short-term fluctuations.

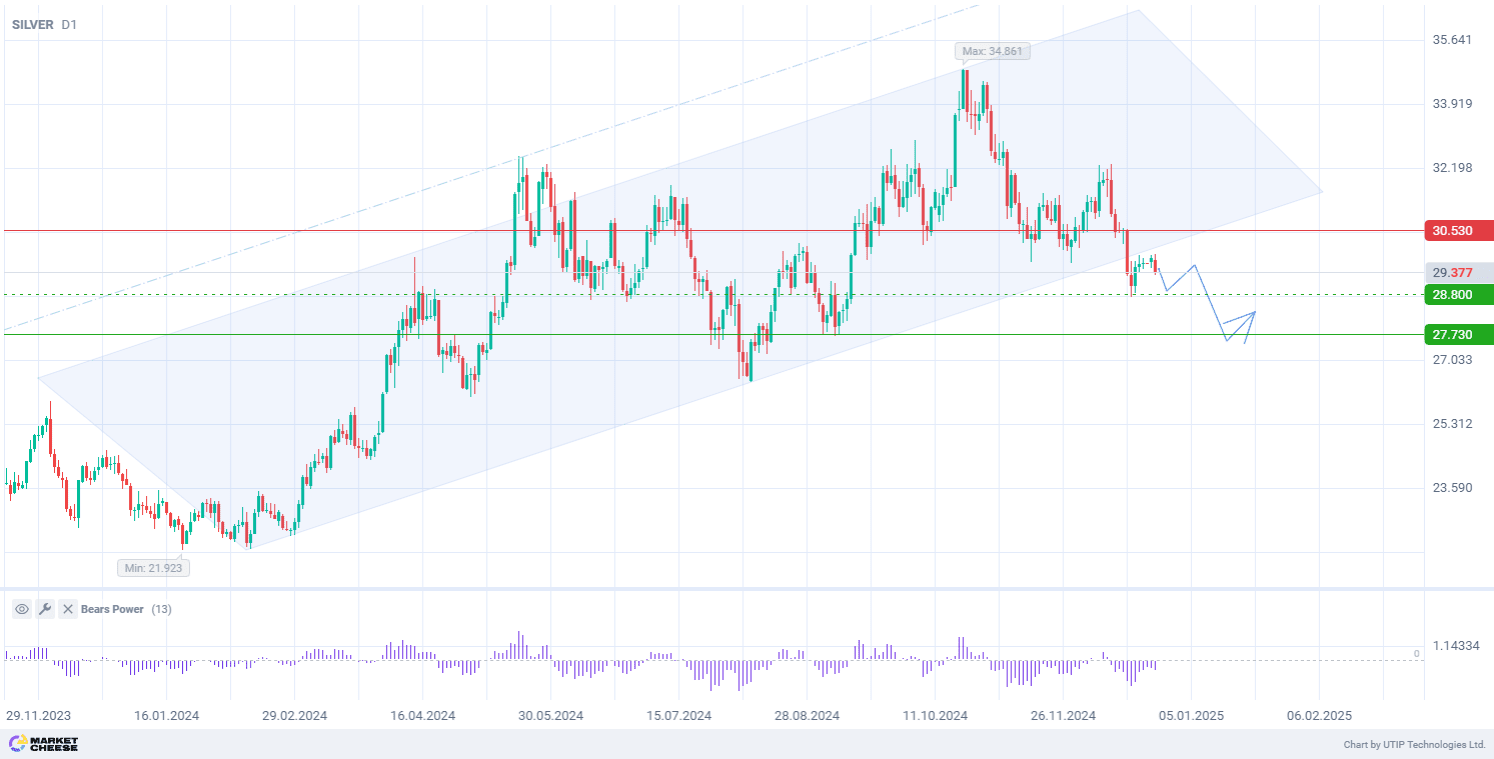

From a technical point of view, on the daily timeframe (D1) silver quotes went out of the uptrend. This indicates a possible short-term corrective downward movement or the formation of a new downtrend. The Bears Power indicator (standard settings), remaining in the negative zone, confirms the dominance of bearish sentiment.

Signal:

The short-term outlook for silver is to sell.

The target is at the level of 27.730.

Part of the profit should be taken near the level of 28.800.

A stop-loss could be placed at the level of 30.530.

The bearish trend is short-term, so a trading volume should not exceed 2% of your balance.