Market signals support silver growth prospects

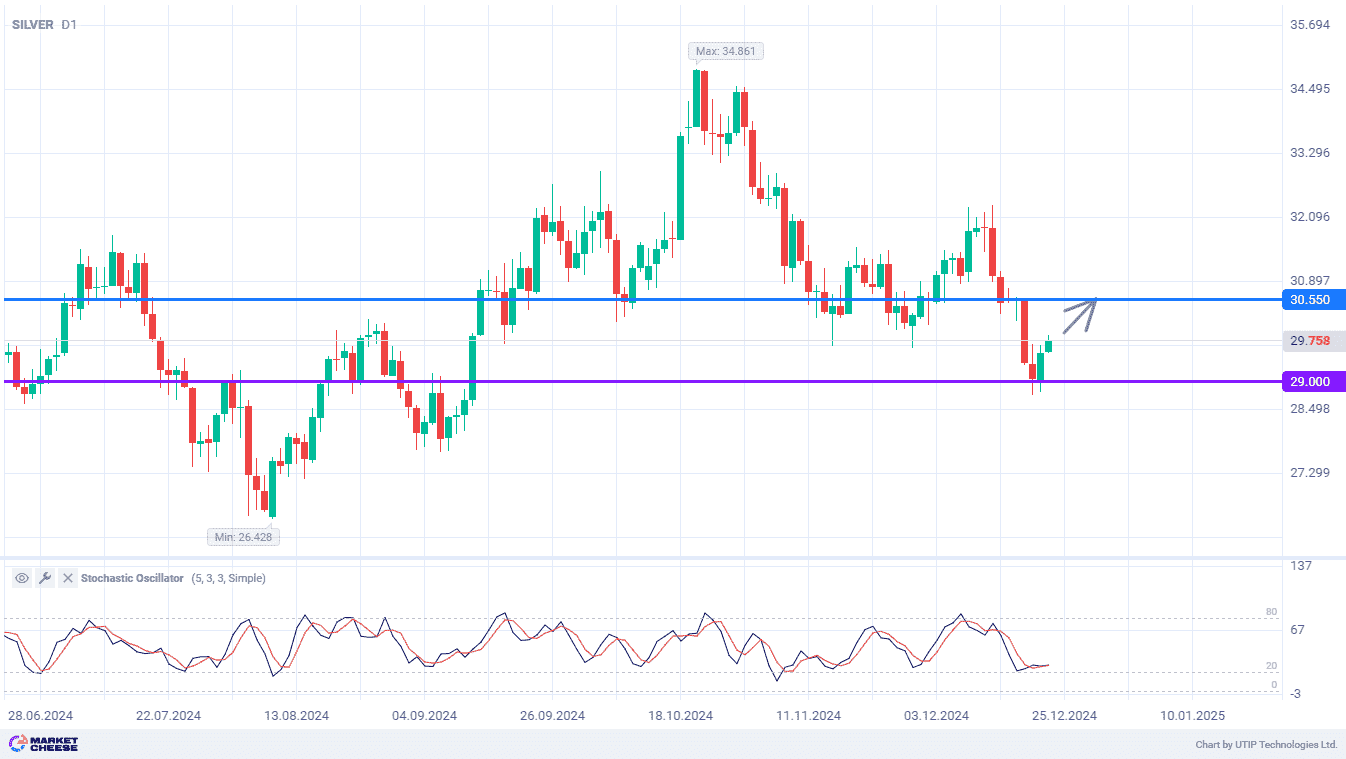

Silver prices fell on Monday, down 0.4%. This was mainly due to the strengthening of the US dollar and profit taking. Meanwhile, investors are awaiting the release of key economic data that could shed light on the Federal Reserve’s (Fed) monetary policy outlook.

As last week’s data showed, progress in reducing US inflation seems to have stalled in recent months. This suggests that the Fed may be cautious about further monetary easing.

According to the CME Group’s FedWatch tool, the probability of a 25 basis point rate cut in December is estimated at 65.4%.

This week, investors are awaiting the release of US employment, payrolls and wages data. Market participants are expecting a rise in Nonfarm Payrolls to 220,000. A weaker number could reinforce expectations of an interest rate cut, weakening the dollar and supporting silver. Vice versa, a strong employment report could increase bearish pressure on the metal.

Geopolitical events, such as President-elect Donald Trump’s proposed trade tariffs on China, Mexico and Canada, add volatility to the market. Trade tensions have historically supported silver as a safe-haven asset in times of economic uncertainty.

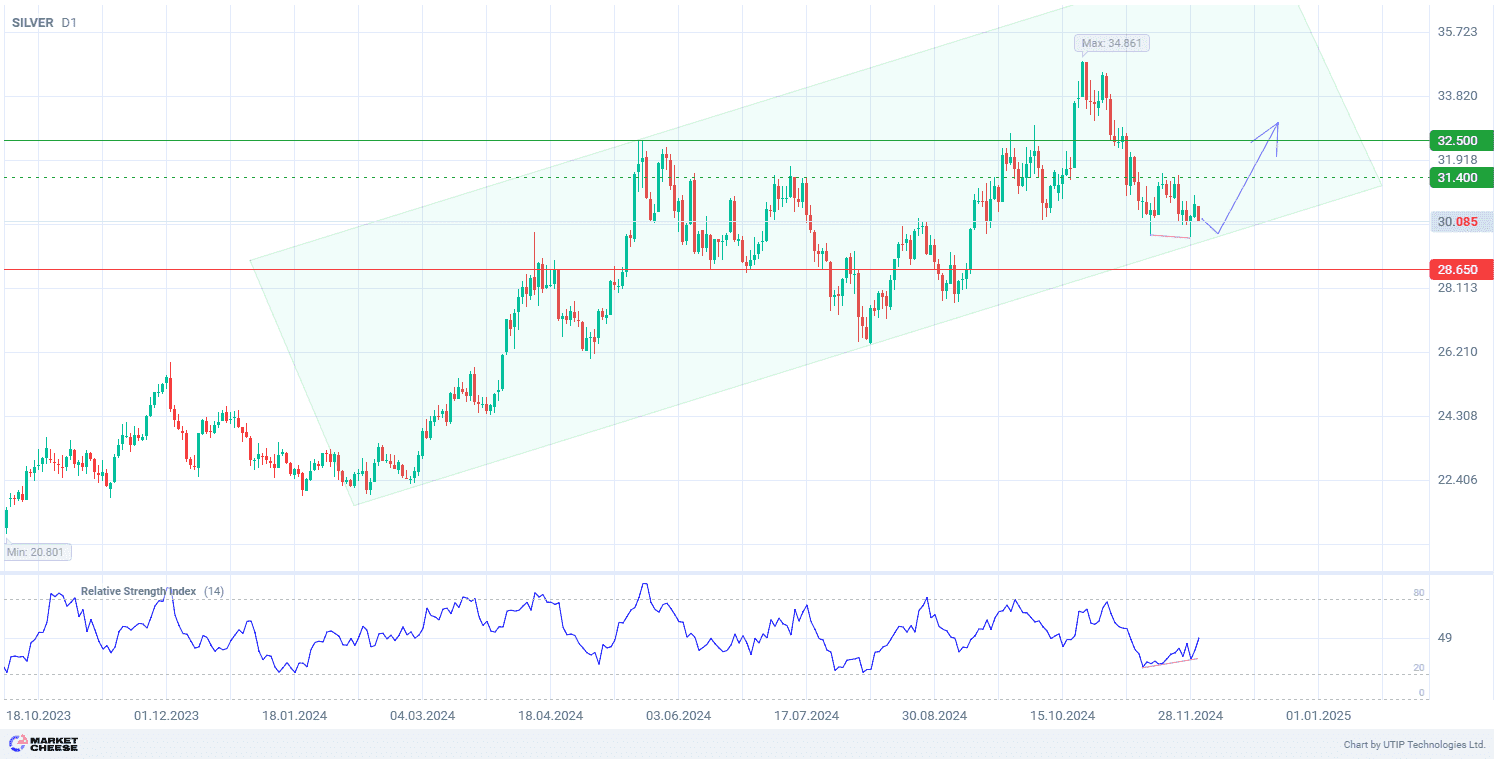

From a technical point of view, silver prices are forming an upward trend on the D1 timeframe. The fundamental data is bringing the price closer to the uptrend support. The Relative Strength Index (RSI) is diverging, indicating the possibility of a price reversal, which is backed up by the trend channel support.

Signal:

Short-term prospects for silver suggest buying.

The target is at the level of 32.500.

Part of the profit should be taken near the level of 31.400.

A stop-loss could be placed at the level of 28.650.

The bullish trend is short-term, so trade volume should not exceed 2% of your balance.