Geopolitical factors and Fed expectations support gold prices

The gold price rose by 0.5% on Monday amid rising geopolitical tensions in the Middle East. Investors are waiting for the publication of macroeconomic data this week, which may give clues about the Fed’s future course of monetary policy.

The escalation of the conflict in the Middle East, including events in Syria, strengthened the precious metal’s position as a safe haven asset. Prices were also supported by the renewed gold purchases by the People’s Bank of China (PBOC) in November after a six-month halt.

Meanwhile, the U.S. Bureau of Labor Statistics reported on Friday that nonfarm payroll employment rose by 227,000 in November. This figure significantly exceeded the revised data for the previous month of 36,000 and was better than the forecasted 200,000.

At the same time, the unemployment rate in November rose to 4.2%. In October, this indicator was 4.1%. The growth of unemployment has strengthened the expectations of market participants regarding the easing of monetary policy at the next Fed’s meeting.

According to CME’s FedWatch tool, the chance of the Fed cutting rates by 25 basis points this month is estimated at 83.4%.

The U.S. consumer price index for November will be in the spotlight this week.

The yellow metal is traditionally seen as a protective asset in times of economic or political instability. This supports the demand for it in the current geopolitical tensions.

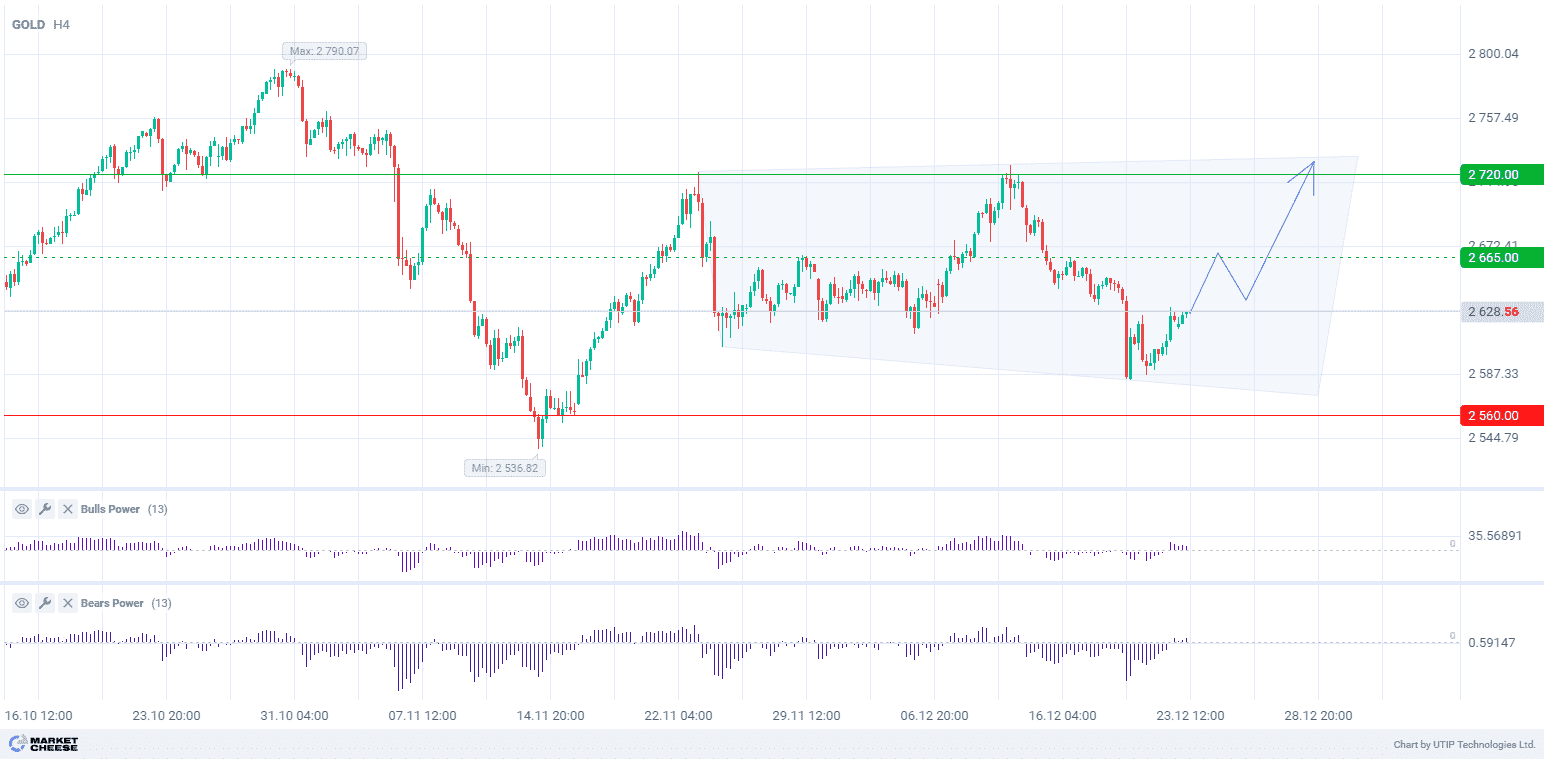

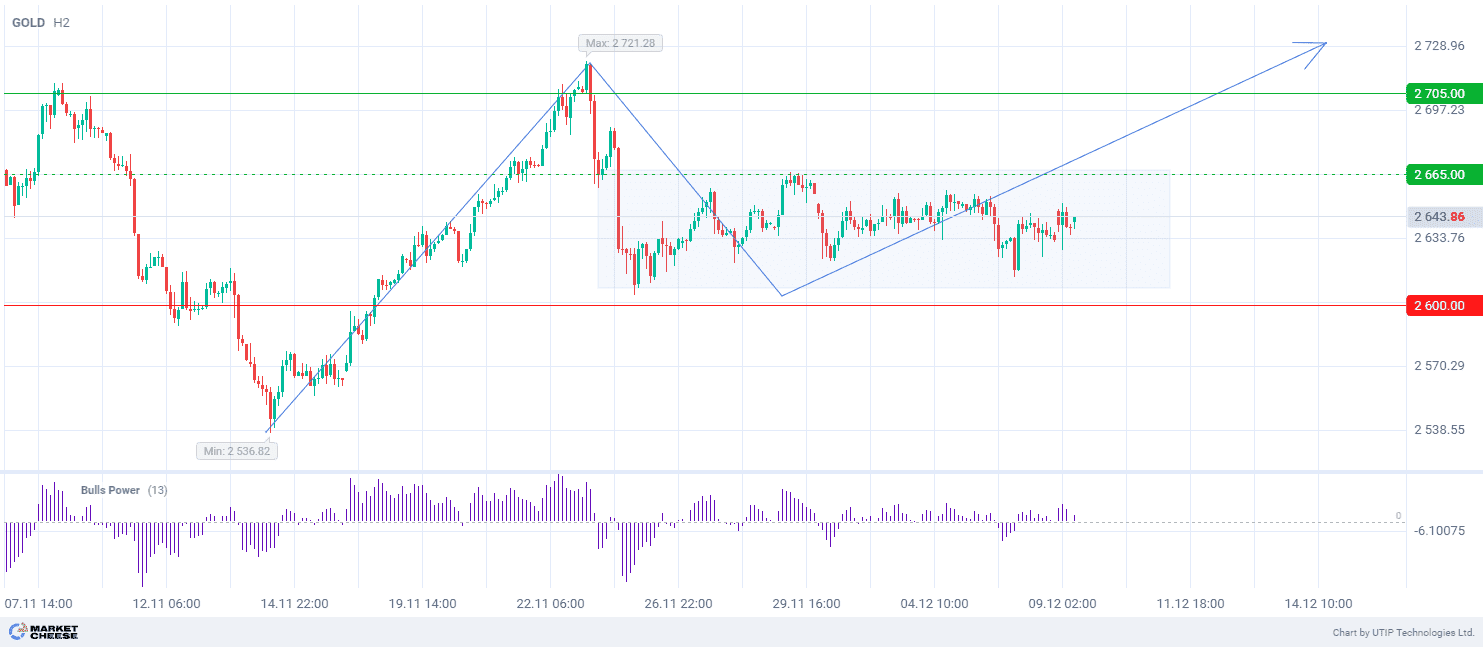

From a technical point of view, gold price is forming a narrow correctional channel on the H2 timeframe. Wave analysis indicates the development of the third ascending wave. Bulls Power (standard values) remains in the positive zone, confirming the dominance of bullish sentiment.

Signal:

The GOLD‘s short-term outlook is to buy.

The target is at the level of 2705.00.

Part of the profit should be fixed near the level of 2665.00.

The Stop loss could be placed near the level of 2600.00.

The bullish trend is of a short-term nature, so it is suggested to limit the trading volume to no more than 2% of your capital.