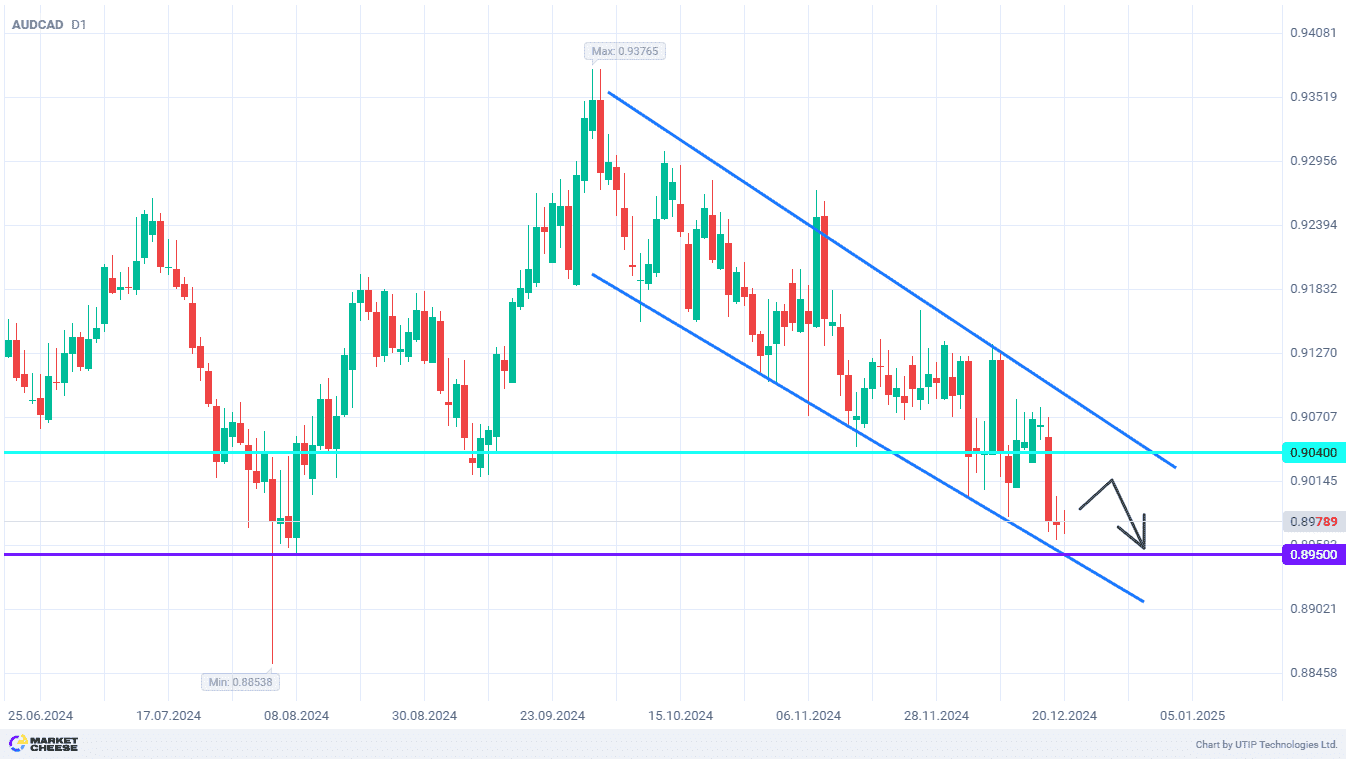

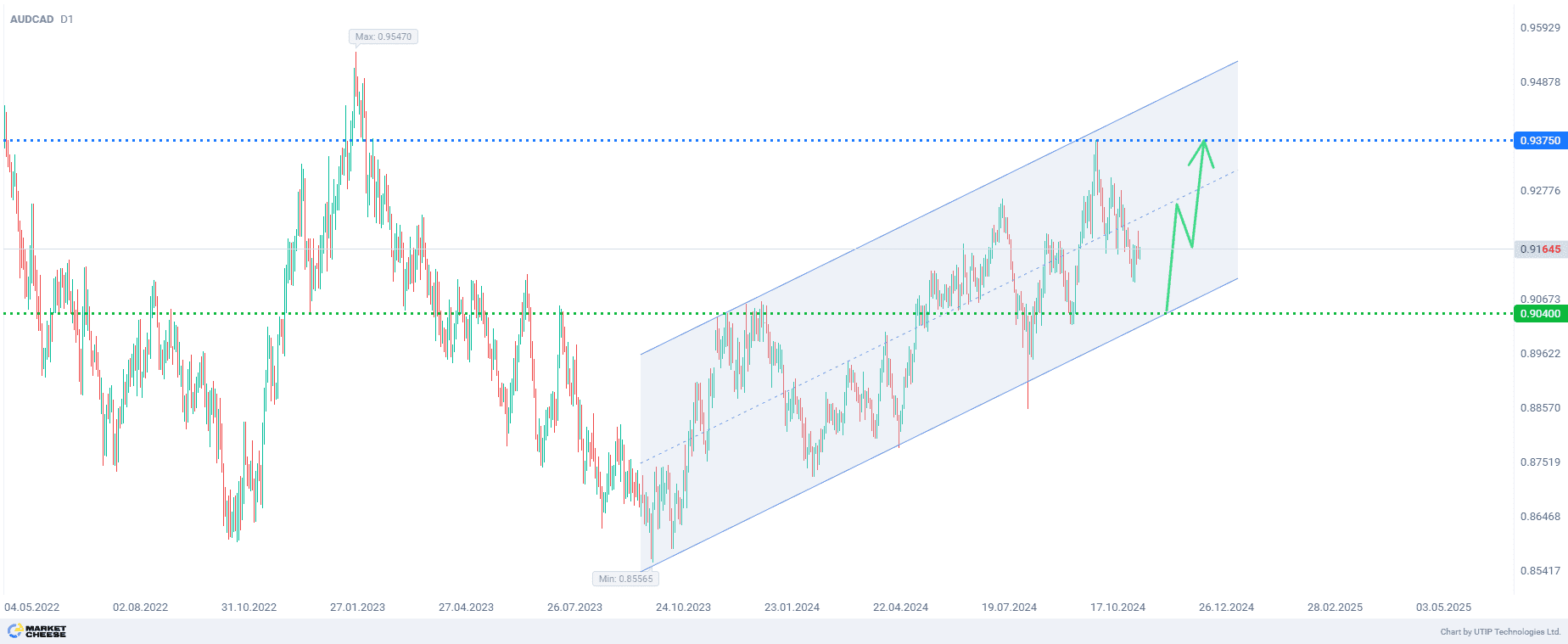

Buy AUDCAD from the level of 0.90400

The AUDCAD currency pair on the daily timeframe since last October has been moving in a well readable ascending equidistant channel. At the moment the quotes are close to the axis of the channel. There are several scenarios for further movement of the currency pair. From the point of view of graphical analysis, the first scenario is that the price will reach the lower boundary of the channel and push up. The second scenario assumes that AUDCAD will go up from the current level. Moreover, this upward movement can have a target both on the upper boundary of the channel and on the levels that are even higher. That is, the price will go up from the boundaries of this range. And finally, the third scenario assumes a downward movement with the subsequent breakdown of the lower boundary and the development of a downtrend.

In order to evaluate the prospects of development of each of these scenarios, it’s worth looking at the fundamental picture of these currencies. Since the regulators of Australia and Canada follow a similar model of dual targeting of inflation and employment through the interest rate, let’s look at these indicators.

Australia’s latest CPI (YoY) was 2.8%, while Canada’s figure was 1.6%. Australia’s unemployment rate is now 4.1%, Canada’s is 6.5%. The RBA’s rate is now 4.35%, the Bank of Canada’s rate is 3.75%.

If one calculates interest rate/inflation ratio in these countries, there will be 1.55 for Australia and 2.34 for Canada. Thus, the Bank of Canada now has more arguments for further rate cuts compared to the RBA. Based on this analysis, AUDCAD is prone to further growth.

According to the technical analysis, the most appropriate buying entry is the moment when the pair touches the lower boundary of the ascending channel, as this approach provides the best ratio of potential profit to potential loss.

The final recommendation is to buy AUDCAD from the level of 0.90400.

The profit could be fixed at 0.93750. The Stop loss could be placed at the level of 0.88000.

The volume of the opened position should be set so that the value of a possible loss, defined with a protective stop order, doesn’t exceed 1% of your deposit.