AUDCAD uptrend indicates the possibility of further pair growth

The AUDCAD pair on Friday shows moderate growth, remaining within the corrective channel. The pair movement is influenced by macroeconomic data from Australia and expectations on the monetary policy of the central banks of the two countries.

The Australian dollar received support after the publication of employment data on Thursday. The seasonally adjusted employment change surged by 35,600 jobs, raising the total number of employed people to 14.535 million. The unemployment rate fell to 3.9%, the lowest since March, and lower than market estimates of 4.2%.

The Reserve Bank of Australia (RBA) kept its key rate at 4.35% at its December meeting. As noted by RBA Governor Michele Bullock, inflation risks have declined, but remain relevant, requiring constant monitoring. The regulator will focus on key economic data, including employment figures, when determining future monetary policy.

Meanwhile, speculation about the introduction of a 10% tariff on Chinese goods by the US is putting pressure on the Australian dollar, as China remains Australia’s largest trading partner. The introduction of such measures could worsen trade conditions and weaken the position of the Australian currency.

The Canadian dollar shows relative stability due to the Bank of Canada’s signals about a slower pace of future rate changes. The head of the regulator Tiff Macklem noted the presence of “a new uncertainty” associated with possible tariffs. At the same time, the central bank’s focus remains on the domestic economy, limiting the decline of the Canadian currency.

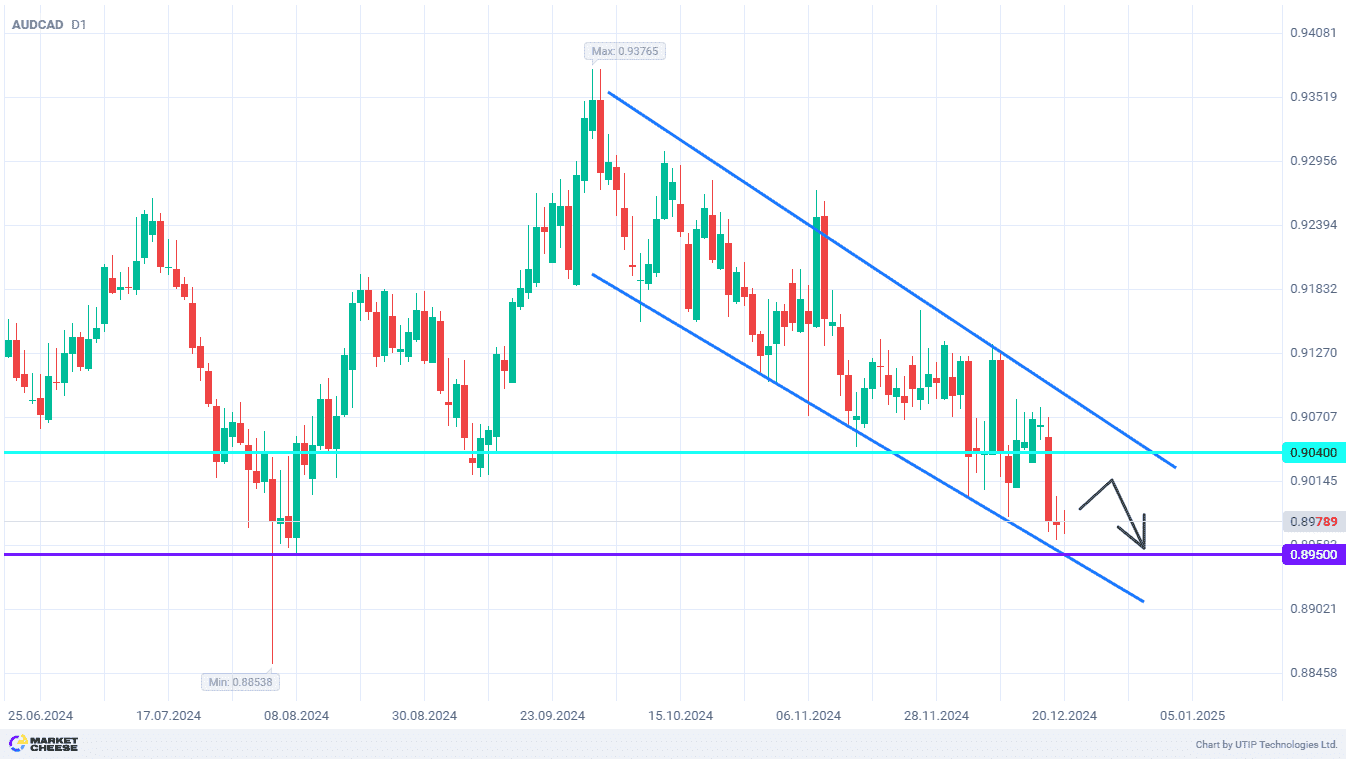

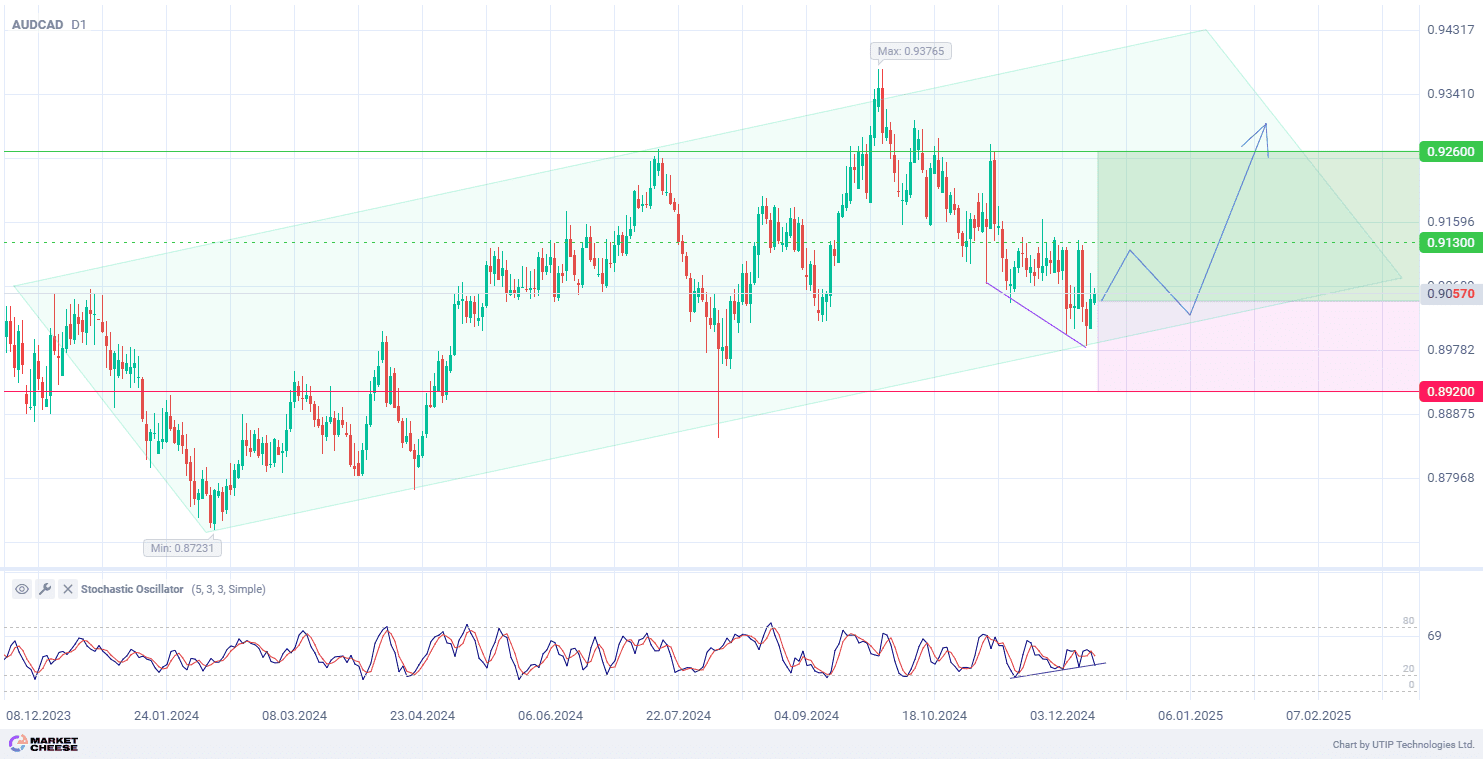

According to the technical analysis, the pair is forming an uptrend on the D1 timeframe. The price rebounded from the trend channel support, signaling a possible continuation of growth. Divergence of the Stochastic Oscillator indicator (settings 5, 3, 3), which was observed during the decline to the channel support, confirms the possibility of upward movement.

The short-term outlook for the AUDCAD pair is to buy with the target at 0.9260. Part of the profit could be fixed near 0.9130. The Stop loss could be placed at 0.8920.

The bullish trend is of a short-term nature, so it is suggested to limit the trading volume to no more than 2% of your capital.