Silver correction provides more buying opportunities

Silver prices consolidated near last week’s low. The market was pressured by US inflation data and a stronger dollar. Investors remain cautious ahead of the Federal Reserve (Fed) meeting on December 17–18. They assume that the Fed will take a more cautious stance in cutting rates next year because of slowing progress in achieving the 2% inflation target.

The Consumer Price Index (CPI) for November rose 2.7% year-on-year, while core inflation was 3.3%. Meanwhile, the Producer Price Index (PPI) rose 3% year-on-year, reinforcing expectations of a modest rate cut in the US.

Aside from the expected 25-basis-point rate cut in the States, the accompanying statement and comments from Fed Chairman Jerome Powell will be of key importance. At the press conference, he may outline the regulator’s approach to balancing inflation risks and economic growth in 2025. These expectations support the US currency strengthening, putting pressure on the silver price.

At the same time, geopolitical tensions in the Middle East boost demand for the white metal as a safe-haven asset. However, moderate global industrial consumption and central banks’ preference to buy gold also limit silver’s upward momentum.

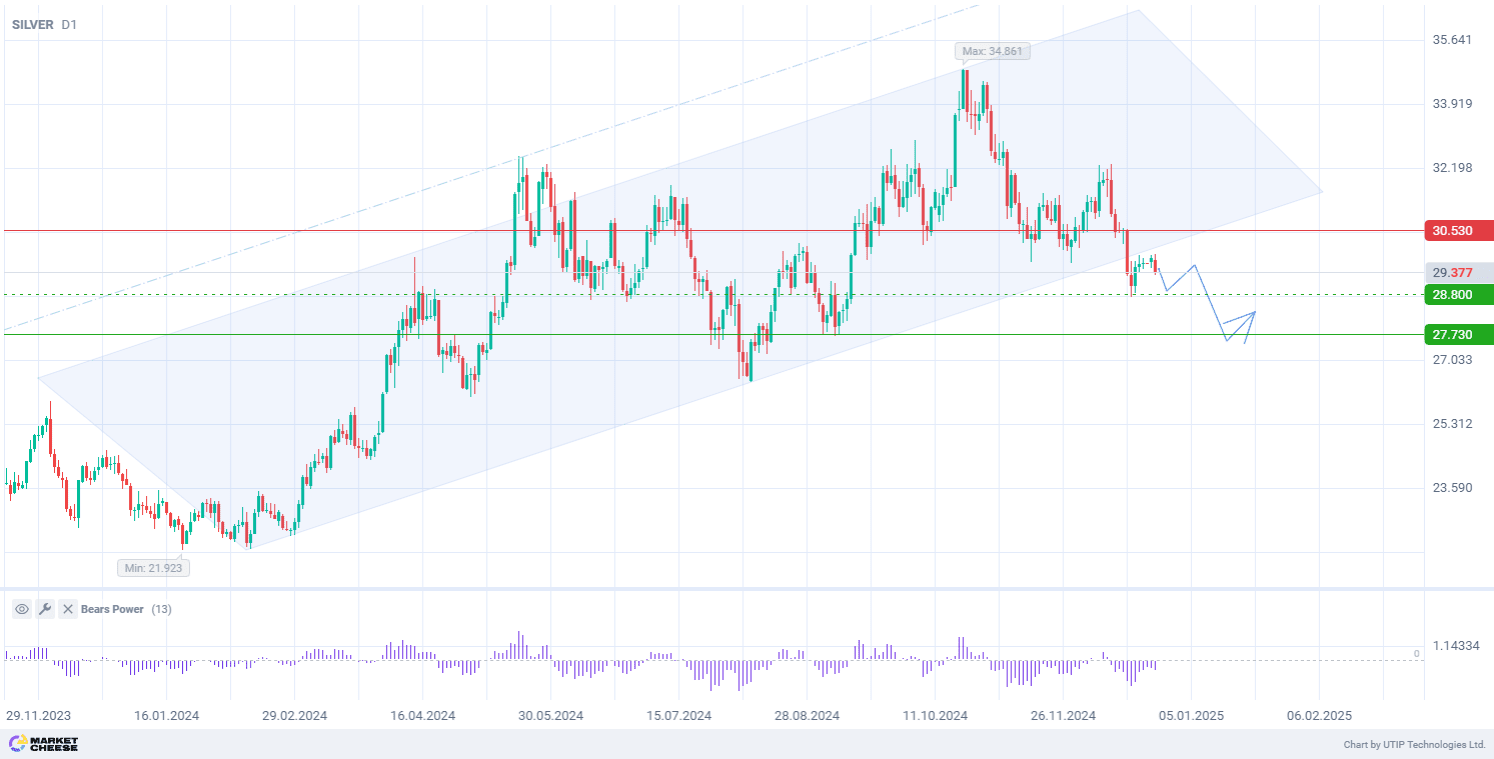

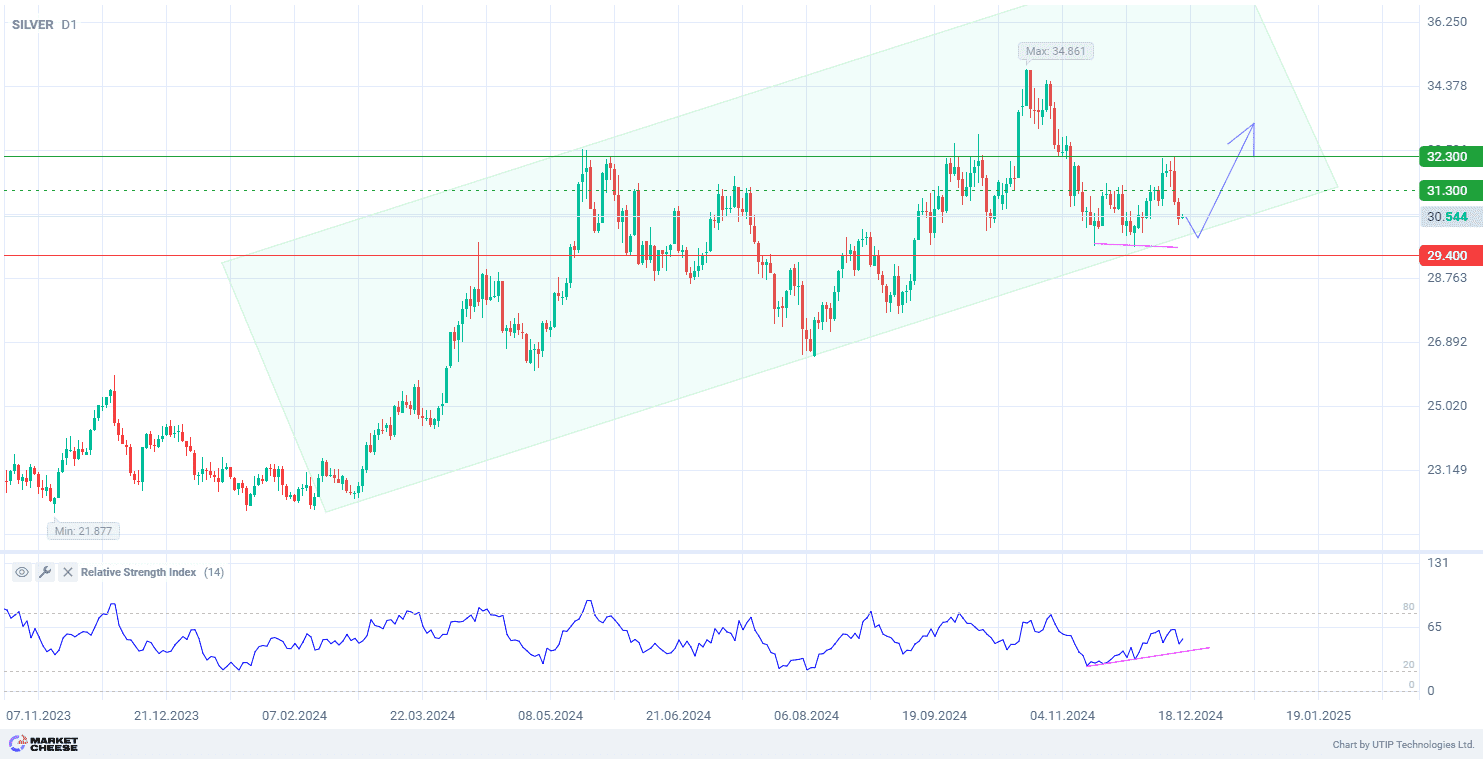

From a technical point of view, silver prices are forming an ascending trend on the D1 timeframe. Fundamental data are bringing them closer to the ascending support. The Relative Strength Index divergence (standard values), which has been in place since late November, confirms the reliability of the current trend line.

Signal:

The short-term outlook for silver suggests buying.

The target is at the level of 32.300.

Part of the profit should be taken near the level of 31.300.

A stop-loss could be placed at the level of 29.400.

The bullish trend is short-term, so a trading volume should not exceed 2% of your balance.