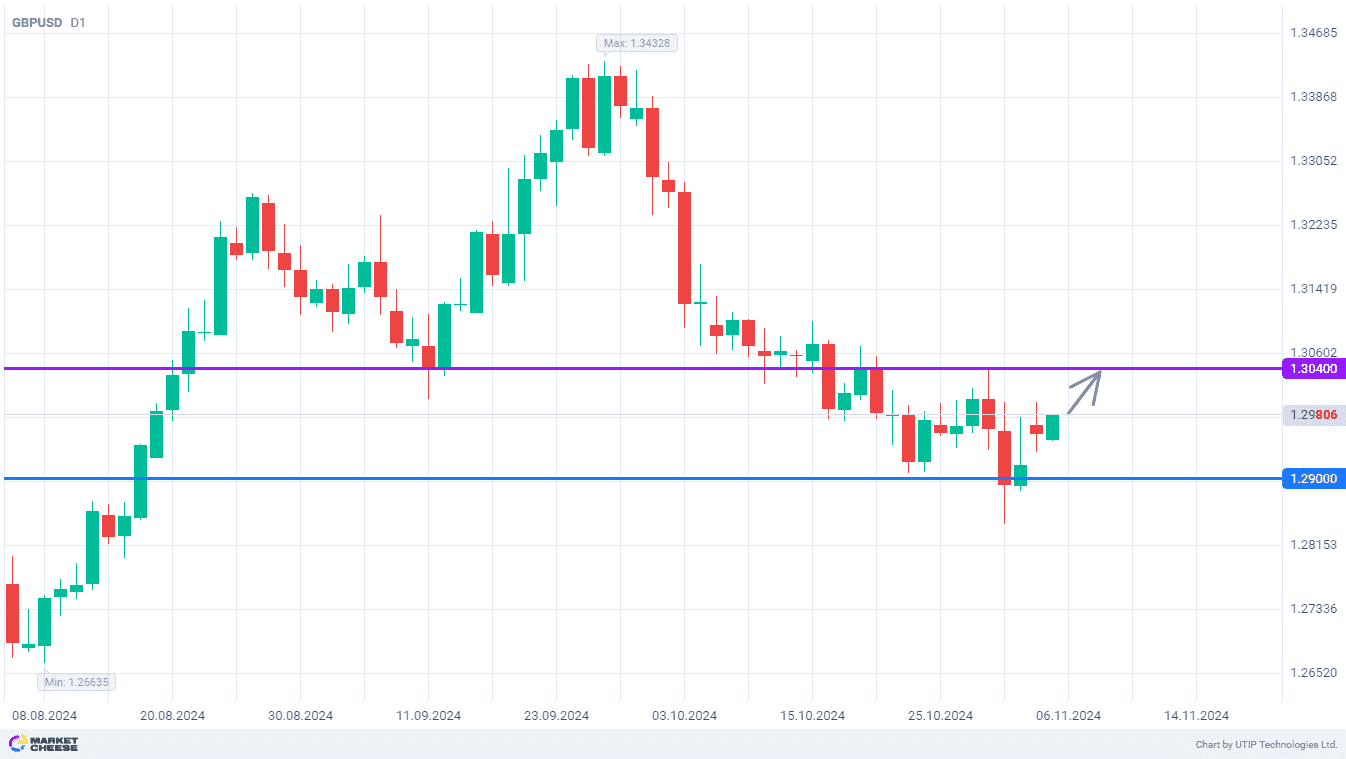

GBPUSD rebounds towards the level of 1.304

The GBPUSD currency pair at the end of last week fell below the 1.29 level for the first time since mid-August. The sellers’ activity has noticeably decreased, and the bulls seized the initiative. If on Friday most of the growth was lost by the end of the trading session, yesterday’s result was much more positive. The quotes rebound has a short-term potential up to 1.304, where the bears can provide serious resistance.

The main driver for the pound recently was the 2025 budget, presented by Chancellor Rachel Reeves last week. As expected, the document assumes a significant increase in taxes in the UK, but the state’s expenditures will also show considerable growth. Against this backdrop, the Office for Budget Responsibility (OBR) has sharply raised its forecast for inflation in the country. According to the new estimate, the rate of price growth in 2025 will be 2.6% rather than 1.5%.

ING analysts believe that these changes will affect the Bank of England’s future monetary policy. By the close of the meeting on November 7, the key rate will certainly be reduced by 0.25%, but a similar move in December may not happen. ING experts estimate the chances of a December pause in the cycle of policy easing by the British regulator at almost 50%. As expected, the head of the Bank of England Andrew Bailey won’t talk directly about plans for the last month of the year, but his rhetoric will probably tighten.

ING experts have also strengthened their pound forecasts. Over the past month, the level to which the British regulator is expected to bring the key rate in the current cycle of its reduction, increased by 75 basis points. In terms of the outcome of the US presidential election, the impact on the pound shouldn’t be as strong as on the euro and most other G10 currencies. And the latest report on the US labor market speaks in favor of further easing of the Fed’s policy and reducing the pressure on GBPUSD.

The nearest target for GBPUSD buyers is the level of 1.304. Further price dynamics will depend on the results of the US elections and central banks’ meetings on Thursday.

The following trading strategy can be suggested:

Buy GBPUSD at the current price. Take profit — 1.304. Stop loss — 1.29.