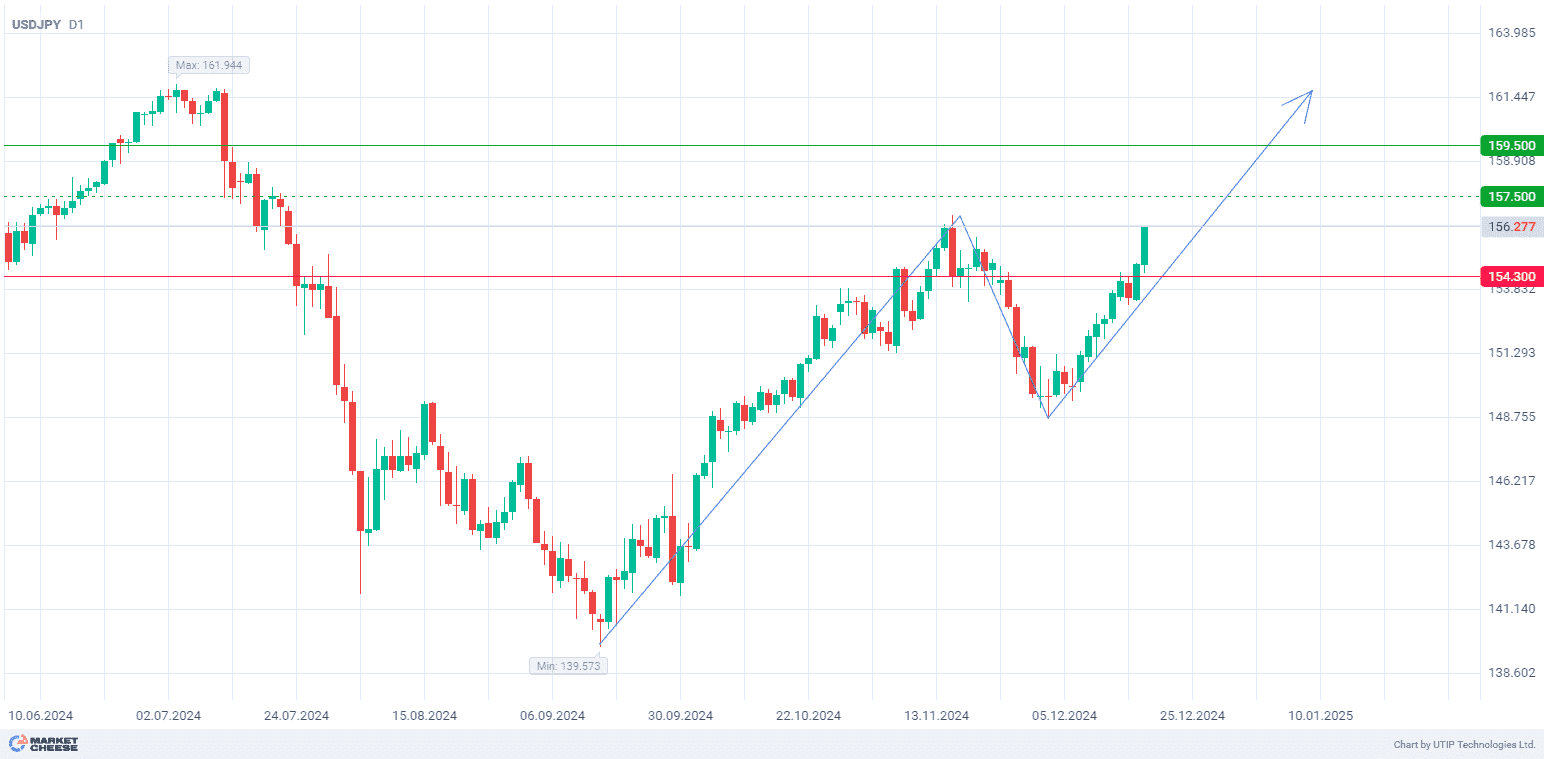

Buying USDJPY with target at 159.50

USDJPY rose above the psychological level of 155.00 on Thursday after the Bank of Japan (BoJ) decided to keep interest rates unchanged in the 0.15–0.25% range after its two-day meeting. The decision of the Japanese regulator, along with a stronger US dollar after the Federal Reserve’s (Fed) interest rate announcement, continues to reinforce the yen’s status as a low-yielding asset.

The BoJ expects an increase in the consumer price index in 2025 on the back of higher wages and private consumption. However, this positive outlook is constrained by current forecasts for the rates to remain unchanged, keeping the yen from strengthening. At a press conference, Kazuo Ueda, head of the BoJ, emphasized that the regulator is ready to consider raising rates in January or in March if inflationary trends intensify.

Meanwhile, the Fed cut its benchmark interest rate by 25 basis points to a range of 4.25–4.50%, but maintained a cautious outlook. According to an accompanying statement, the policymakers now forecast only two rate cuts of a quarter-point each next year. This is considerably less than its September forecast of four rate cuts. As noted by Fed Chairman Jerome Powell, further rate cuts require more progress in reducing inflation, which remains above the target level.

Investors are now focused on the US GDP data, initial jobless claims and core personal consumption expenditures set to be released in the coming days.

Fundamentals are currently supporting the USDJPY growth, while the pair’s short-term dynamics depend on the upcoming data from the US.

From a technical point of view, the USDJPY pair is forming a new uptrend on the D1 timeframe. In terms of wave analysis, the pair is forming the third ascending wave. Breaking through the top of the first wave at 156.75 will be a signal for further upward movement.

Signal:

The short-term outlook for the USDJPY currency pair suggests buying.

The target is at the level of 159.50.

Part of the profit should be taken near the level of 157.50.

A stop-loss could be placed at the level of 154.30.

The bullish trend is short-term, so a trading volume should not exceed 2% of your balance.