Analysis

Successful trading in the market is impossible without competent analysis. Fundamental and technical analysis are two key tools that help traders make informed decisions and effectively manage risks.

Open an accountFundamental analysis

In order to make certain decisions in the market, it is not enough just to follow the charts, experienced traders understand the importance of fundamental analysis.

Market movements are driven by fundamental factors. These are the key macroeconomic indicators of the national economy, which influence the market participants and the level of currency rates. It is these factors that fundamental analysis studies.

Methods of fundamental analysis

Comparison

After the publication of economic indicators, traders instantly react to deviations from expectations, causing significant fluctuations in the exchange rate.

Fundamental analysis allows us to evaluate this data: the greater the deviation from the forecast is, the stronger the market reaction will be, thus leading to a massive opening or closing of positions.

Seasonality

Seasonal factors have a significant impact on asset values and investor interest, particularly in the stock market. Sales figures and macroeconomic data are seasonally adjusted to more accurately gauge their deviations from the norm.

This helps traders predict price fluctuations and make informed decisions in low-volatility markets.

Induction and deduction

Traders use induction to gather various indicators and news to predict price movements. Deduction, on the other hand, helps draw conclusions in trend trading from the general to the specific, which is particularly important when analysing stocks.

Although this method is complex and subject to error, it can provide valuable insights, for example, when evaluating the EURUSD situation.

Correlation

A combined method of fundamental and technical analysis where the price movement of one asset impacts the other.

The calculations used to be complex, but traders can now use correlation indicators such as Overlay Chart and INDCOR Correlation to simplify analysis on trading platforms.

Classification and generalization

This method is used at the professional level, when assets are grouped by behavior and characteristics to calculate an overall index.

For example, when analyzing the stock market, you can create your own macroeconomic indicator similar to the Dow Jones, which includes 30 stocks of large companies.

Technical analysis

Technical analysis is an attempt to mathematically predict market movements based on previous price data. Traders use formulas, algorithms and indicators to turn a quote chart into a logically ordered structure where human psychological factors play a central role.

The main purpose of technical analysis is to determine the current trend and find the optimal moment to make a trade based on chart data.

Technical analysis methods

-

Chart price action

You look at a chart and try to find the shapes that Japanese candlesticks form. Some of these patterns signal a price reversal, while others point to a continuation of the trend. There are also patterns of uncertainty, when the asset itself does not yet know where it is going next.

-

Mathematical analysis

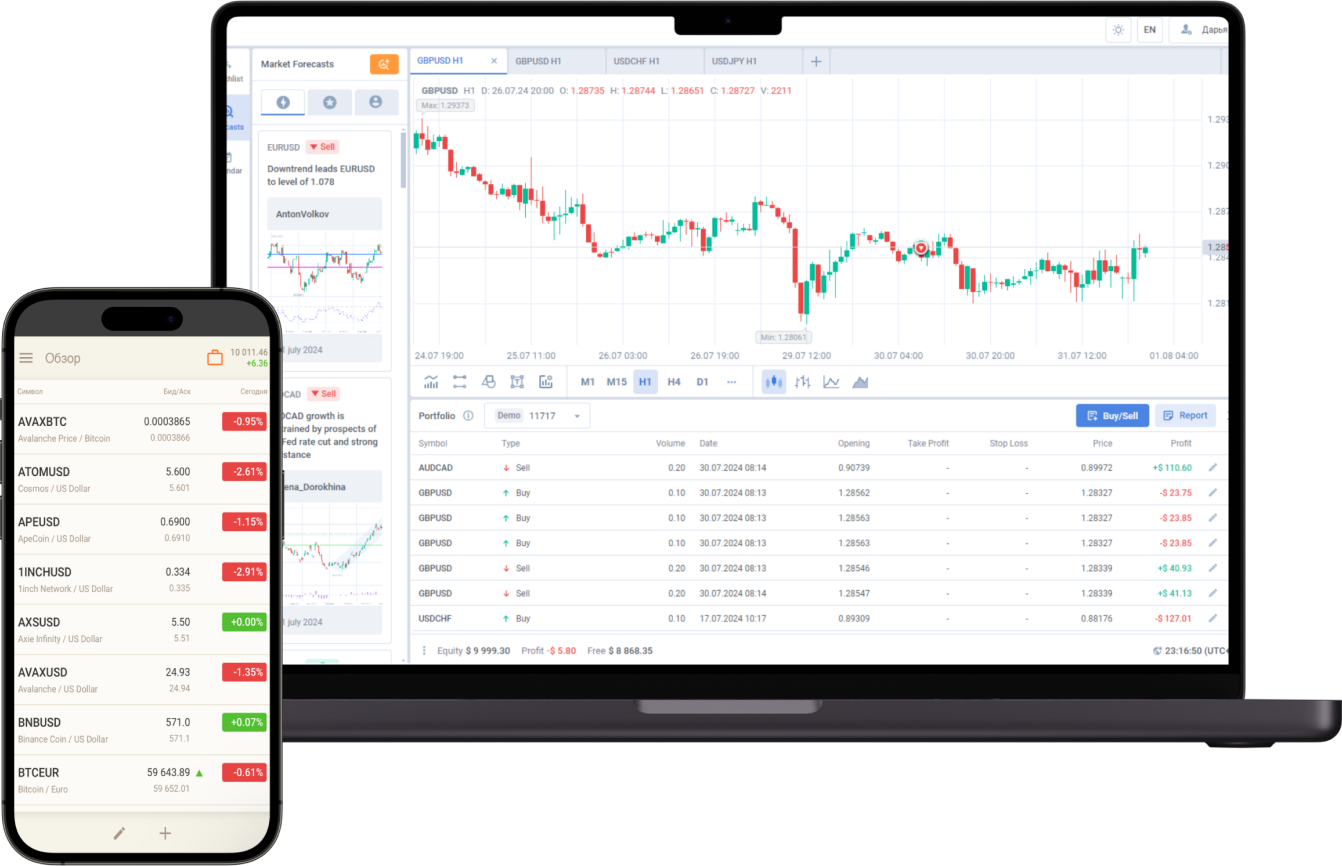

You select technical indicators on the trading platform: various lines, which are based on various formulas that make calculations with the price based on previous quotes. These indicators help to visually identify the best moments to open trades (give signals) and the current assessment of the situation from the life cycle of the trend.

-

Candlestick

analysisYou analyze the Japanese candlesticks: closing levels, opening levels, length, and which candlesticks are on the sides. This method is similar to chart analysis and is a more detailed version of it

-

Volume

analysisAn increase in the volume of transactions in the market confirms the strength of the trend, while a decrease confirms its weakening. The On Balance Volume (OBV) indicator relates volume to price changes, helping traders assess the reliability of a move.