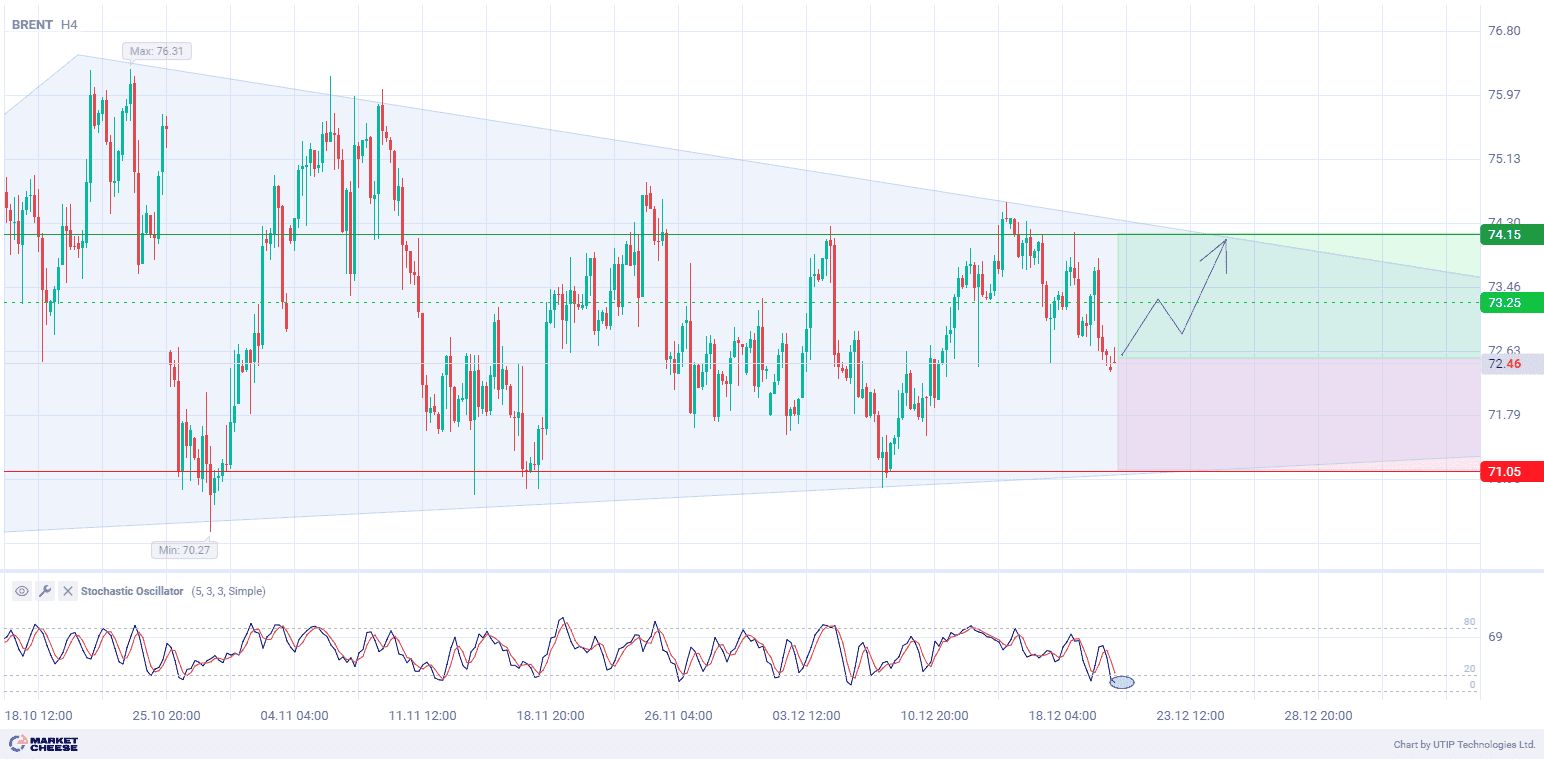

Brent oil is forming upside potential in triangle pattern

Brent crude oil prices rebounded moderately on Friday after declining by 0.33% during the previous trading session in light of a stronger US dollar.

The US currency rose on signals from the Federal Reserve (Fed) of fewer interest rate cuts next year. This makes oil more expensive for those who use other currencies.

China’s oil imports may peak as early as 2025, while oil demand may peak by 2027, based on an annual forecast by China’s Sinopec. Such an outlook is explained by reduced consumption of fuel and gasoline in the country. It adds to concerns about the future of the world’s largest importer of hydrocarbons.

Oil prices are heading for a moderate year-on-year decline after trading in the narrowest range since 2019. Weaker demand from China, rising production in the US and prospects for stronger trade restrictions against Iran and Russia put major pressure on the prices.

At the same time, the G7 countries are considering new limit measures against Russian oil. Among the discussed options are lowering the price ceiling down to $40 per barrel from the current level of $60 or imposing an outright ban. However, there is no consensus among Western countries on this issue yet.

Continued uncertainty around demand and international politics keeps shaping the outlook for the oil market.

From a technical point of view, Brent oil prices are in an uncertain triangle pattern on the D1 timeframe. The price remains in the middle of this range. At the same time, the Stochastic Oscillator (with settings 5, 3, 3, Simple) has entered the oversold zone on the H4 timeframe. The curve exit from this zone may signal buying opportunities in the triangle pattern.

Short-term prospects for Brent oil prices suggest buying with the target of 74.15. Part of the profit should be taken near the level of 73.25. A Stop loss could be set at 71.05.

Since the bullish trend is short-term, the trading volume should not exceed 2% of your total balance to reduce risks.