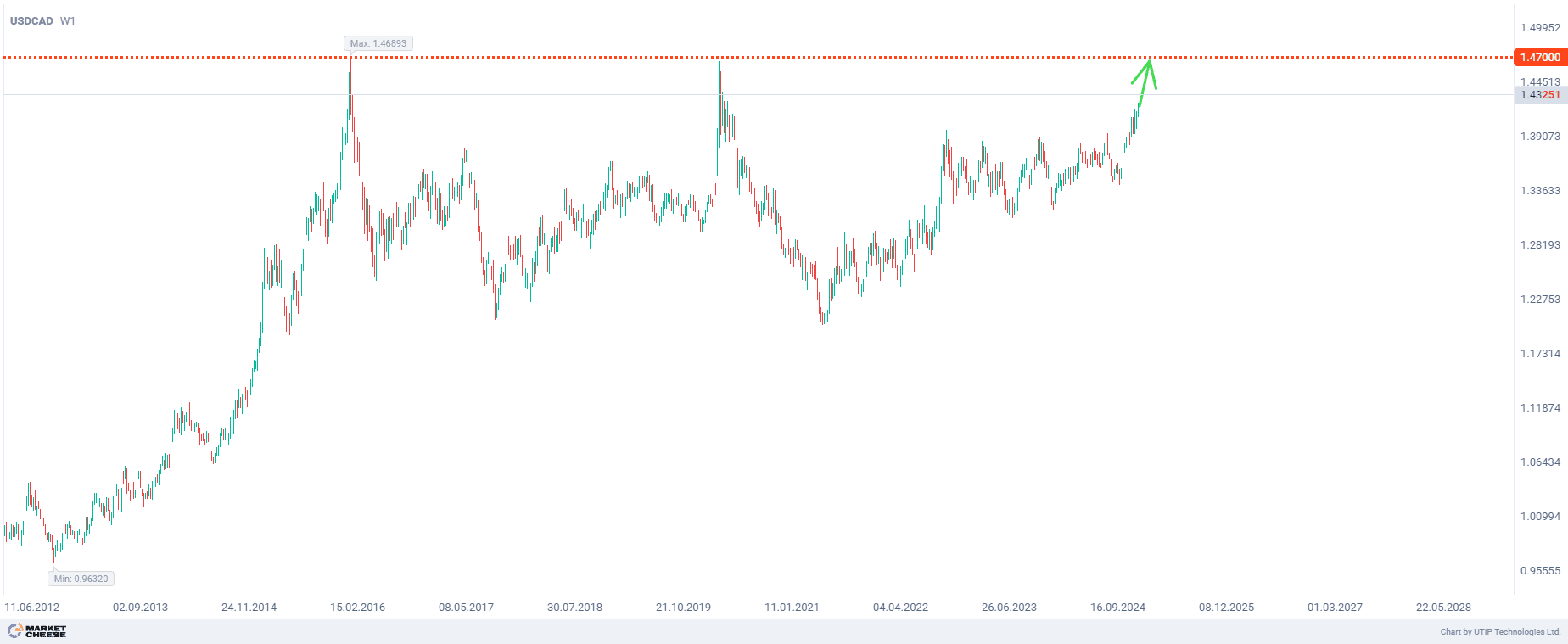

USDCAD aims for previous highs at 1.4700

Canada’s year-on-year inflation rate unexpectedly fell to 1.9% in November due to a slowdown in price growth, while the month-on-month Consumer Price Index (CPI) was unchanged.

Previously, analysts polled by Reuters had forecast year-on-year inflation to hold at 2% and the CPI to rise 0.1% from the month before. Preferred gauges of core inflation adopted by Canada’s central bank — the median CPI and declining CPI — remained unchanged, although the previous month’s data were revised upward.

The economists noted that continued tight policy could be a problem for the Bank of Canada (BoC), which has stated earlier that with inflation falling consistently, it is important for the bank to cut rates in order to support the economy.

First of two inflation reports was released yesterday, on Tuesday, which the BoC will consider before making its next interest rate decision on January 29.

The foreign exchange market sees a 55% probability of a 25-basis-point rate cut in January.

From a technical point of view, the USDCAD currency pair aims to test the level formed on major timeframes at 1.4700. This level was technically confirmed in January 2015 and in March 2020. It is not excluded that this time USDCAD will manage to break through this level and rise even higher, approximately to the range of 1.5000–1.5500.

The overall recommendation is to buy USDCAD.

Profits should be taken at the level of 1.4700. A Stop loss could be set at the level of 1.3450.

The volume of the opened position should be set in such a way that the value of a possible loss, fixed with the help of a protective Stop loss order, is no more than 1% of your deposit funds.