Slowdown in Canadian economy and other supportive factors are likely to push AUDCAD higher

On Friday, the AUDCAD currency pair is growing moderately, continuing the three-day corrective dynamics. The Australian dollar strengthened after comments from the Governor of the Reserve Bank of Australia (RBA) Michele Bullock. As she noted in her speech, inflation in the country will remain above the target range for two more years and is unlikely to decline until 2026.

Against this background, ANZ revised its forecasts, expecting the RBA to postpone interest rate cuts until May instead of February. These changes increased support for the Australian currency.

Traders are also focused on Canada’s gross domestic product (GDP) data today. The Canadian economy is expected to grow at a 1.0% year-on-year rate in the third quarter, compared to 2.1% in the second quarter. On a monthly basis, GDP is expected to grow 0.3% for September, above August’s zero reading.

If the data show a slowdown in the Canadian economy, it could increase pressure on the Canadian central bank, which may decide to cut rates by 50 basis points at its next meeting on December 11. Such a policy could weaken the Canadian dollar, supporting AUDCAD growth. In addition, on Friday, the report on Canada’s government budget balance will be published. This document reflects all sources of revenues and expenditures of the state budget.

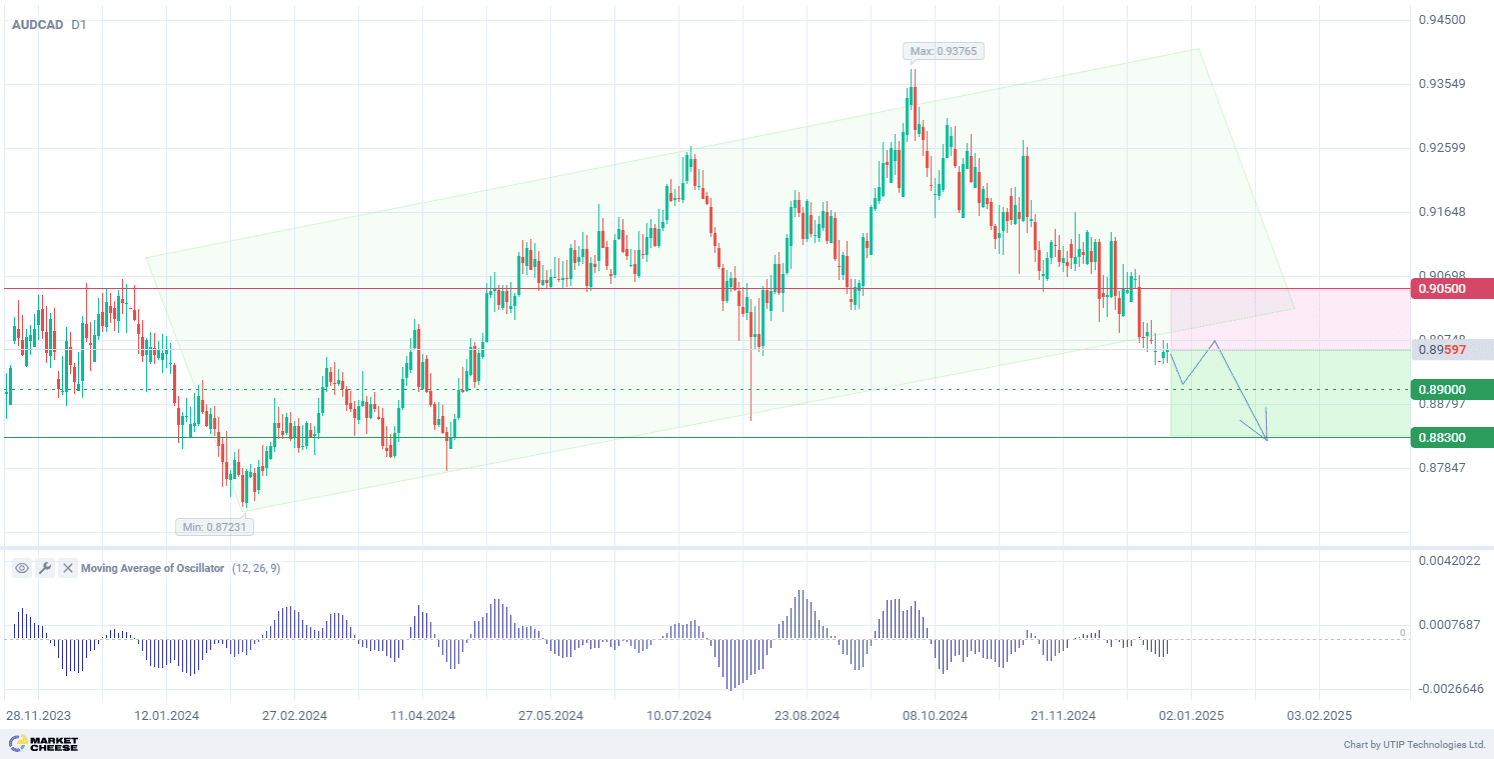

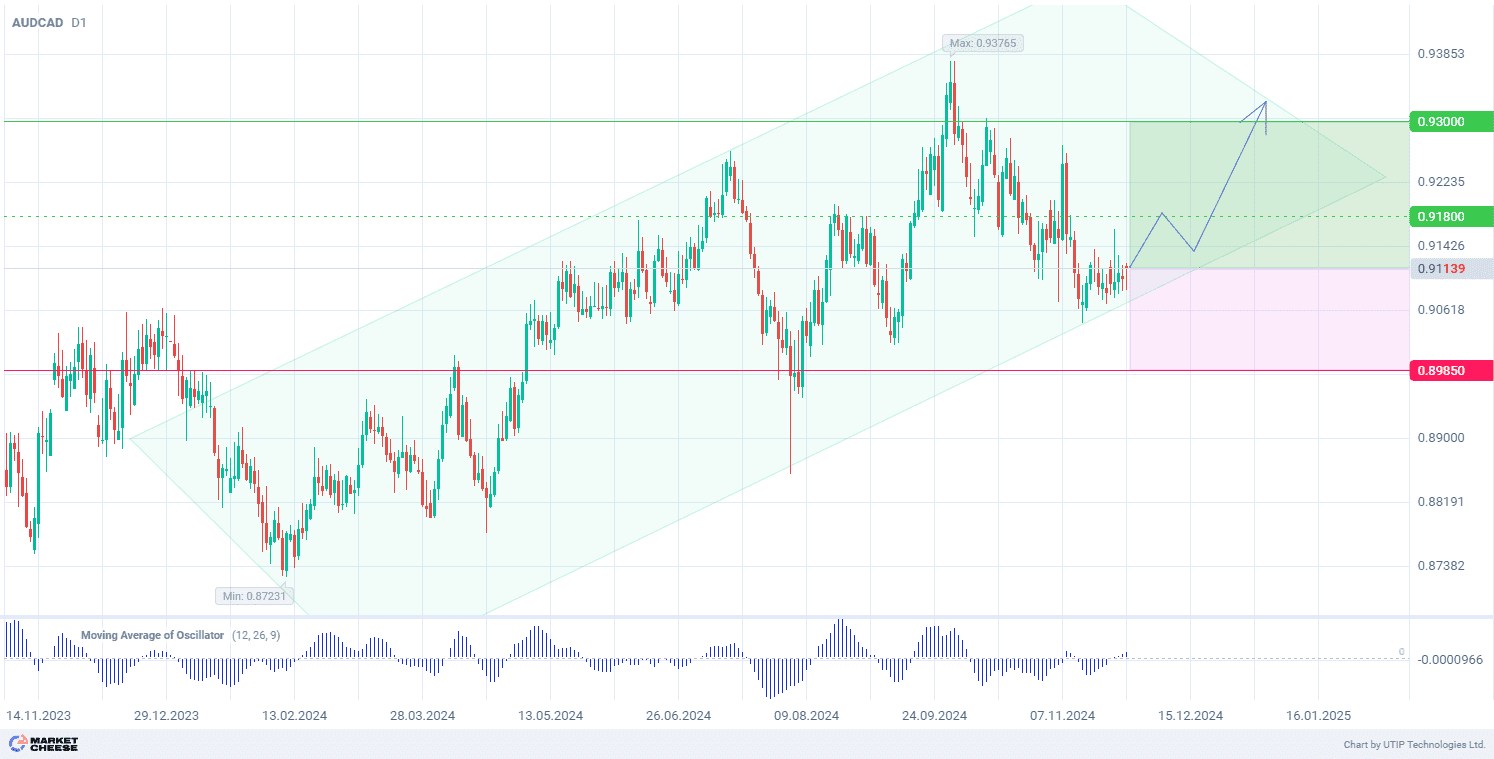

Technical analysis of AUDCAD on the D1 timeframe indicates the formation of an uptrend. The price bounced from the trend channel support, signaling a possible continuation of growth within the upward movement. The Moving Average of Oscillator indicator (parameters 12, 26, 9) has moved to the positive zone, confirming the strength of the bullish sentiment.

Short-term prospects for the AUDCAD suggest buying with the target at 0.9300. Part of the profit should be taken near the level of 0.9180. A Stop-loss could be set at 0.8985.

Since the bullish trend is short-term, the trading volume should not exceed 2% of your total balance to reduce risks.